In this article we will discover hassle-free HDFC Bank RTGS form filling tips which will simplify your transactions. In today’s digital age, where instantaneous transactions have become the norm, services like Real Time Gross Settlement (RTGS) play a pivotal role in facilitating fund transfers. HDFC Bank stands out for its efficiency and reliability among the various banks offering RTGS services. However, to leverage this service seamlessly, it’s essential to understand the process of filling out the HDFC Bank RTGS form accurately.

Introduction

HDFC Bank, one of India’s leading private sector banks, offers a wide banking services tailored to meet the diverse needs of its customers. Among these services, RTGS enables individuals and businesses to transfer funds swiftly and securely across different bank accounts in quick time.

What is RTGS?

RTGS, short for Real Time Gross Settlement, is a payment system that enables real-time fund transfers on a gross basis. Unlike other modes of fund transfer that operate on a net settlement basis, where transactions are processed in batches at specific intervals, RTGS transactions are settled individually and immediately upon initiation. You need to fill out the HDFC RTGS form for transferring 2 Lakhs or more, while the NEFT form is necessary for transferring amounts less than 2 Lakhs.

Importance of HDFC Bank RTGS Form filling

Filling out the HDFC Bank RTGS form correctly holds immense significance as it serves as the primary document for initiating RTGS transactions. Any inaccuracies or omissions in the form can lead to transaction delays or even rejection, causing inconvenience to the sender and the beneficiary.

Understanding the HDFC Bank RTGS Form

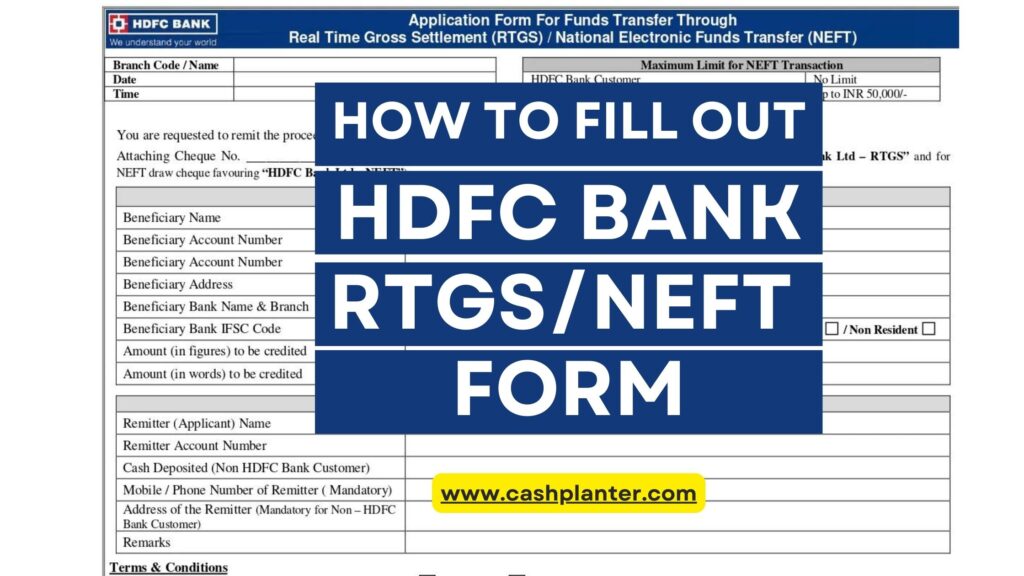

The HDFC Bank RTGS form consists of several sections, each requiring specific information to be filled out accurately.

- Personal Information: This section captures details such as the sender’s name, address, and contact information.

- Account Details: Here, the sender is required to provide information regarding their bank account, including the account number and type.

- Beneficiary Details: The beneficiary’s account details, including the account number, IFSC code, and name, are entered in this section.

- Transaction Details: This section entails specifying the amount to be transferred and the purpose of the transaction.

- Authentication: The sender must sign the form to authenticate the transaction along with a cheque. For RTGS draw cheque favouring “HDFC Bank Ltd – RTGS” and for NEFT draw cheque favouring “HDFC Bank Ltd – NEFT”

How to Fill Out the HDFC Bank RTGS Form

To ensure a smooth transaction process, follow these steps when filling out the HDFC Bank RTGS form:

- Gathering Necessary Information: Before initiating the transaction, gather all relevant information, including account details and beneficiary information.

- Filling Out Personal Details: Provide accurate personal information as per the records maintained by the bank.

- Providing Account Information: Double-check the account details to avoid any errors in the transaction.

- Entering Beneficiary Details: Verify the beneficiary’s account details, including the account number and IFSC code, before proceeding.

- Specifying Transaction Details: Clearly mention the amount to be transferred and the purpose of the transaction.

- Signing and Authenticating: Sign the form to authenticate the transaction and ensure compliance with banking regulations.

Common Mistakes to Avoid

When filling out the HDFC Bank RTGS form, avoid the following common mistakes:

- Incorrect Account Details: Ensure accuracy when entering account numbers to prevent funds from being transferred to the wrong account.

- Incomplete Beneficiary Information: Provide comprehensive beneficiary details to avoid transaction delays or rejections.

- Wrong Transaction Amount: Double-check the transaction amount to avoid discrepancies in fund transfers.

Tips for Smooth RTGS Transactions

To enhance your RTGS experience with HDFC Bank, consider the following tips:

- Double-Checking Information: Before submitting the form, review all entered information to ensure accuracy.

- Contacting Customer Support: In case of any doubts or queries, reach out to HDFC Bank’s customer support for assistance.

- Keeping Track of Transaction References: Maintain records of transaction references for future reference and tracking purposes.

Advantages of RTGS

Utilizing RTGS for fund transfers offers several advantages, including:

- Instantaneous Transfers: RTGS enables real-time fund transfers, ensuring prompt delivery of funds to the beneficiary.

- Secure Transactions: With stringent security measures in place, RTGS transactions conducted through HDFC Bank are highly secure.

- High Transaction Limits: RTGS allows for high-value transactions, making it suitable for transferring large sums of money.

Conclusion

In conclusion, the art of filling out the HDFC Bank RTGS form is essential for seamless fund transfers. By understanding the form’s intricacies, avoiding common mistakes, and adhering to best practices, individuals and businesses can leverage RTGS to transfer funds swiftly and securely. With HDFC Bank’s robust RTGS services, customers can experience unparalleled convenience in managing their financial transactions. checkout out the sample filled HDFC RTGS form.

You can download the HDFC Bank RTGS Form

FAQs About HDFC Bank RTGS Form Filling

- What is the processing time for an RTGS transaction in HDFC Bank?

- RTGS transactions in HDFC Bank are processed instantly during banking hours.

- Can I use RTGS for international transfers through HDFC Bank?

- No, RTGS is only applicable for domestic transactions within India.

- Is there a limit on the amount that can be transferred via RTGS in HDFC Bank?

- Yes, HDFC Bank imposes a minimum and maximum limit on RTGS transactions, which may vary.

- How can I track the status of my RTGS transaction in HDFC Bank?

- HDFC Bank provides various channels, including internet banking and mobile banking, to track transaction status.

- Are there any charges associated with RTGS transactions in HDFC Bank?

- Yes, HDFC Bank may levy certain charges for RTGS transactions, depending on factors such as the transaction amount and customer relationship.

Here is the sample filled HDFC RTGS & NEFT form

Source : www.hdfcbank.com

Disclaimer: The PDF forms accessible on this website are sourced from the official websites of the respective entities. Additionally, the forms are provided from internet sources. It is important to note that this website is not affiliated with any government entity. Its sole purpose is to facilitate the download of PDF forms. Prior to utilizing any PDF form, it is advisable to verify its authenticity.

While we strive to ensure the accuracy of the provided PDF forms to the best of our knowledge, we do not assume responsibility for any errors that may occur. Users are advised to use the downloaded PDF forms from this website at their own discretion and risk.

Feel free to reach out to us in the event of any updates, as your feedback is invaluable in enhancing the quality of our data. Your collaboration is essential to our continuous improvement efforts. Please contact us with any relevant information that can contribute to refining and updating our data. We appreciate your assistance in maintaining accuracy and relevance in our services.