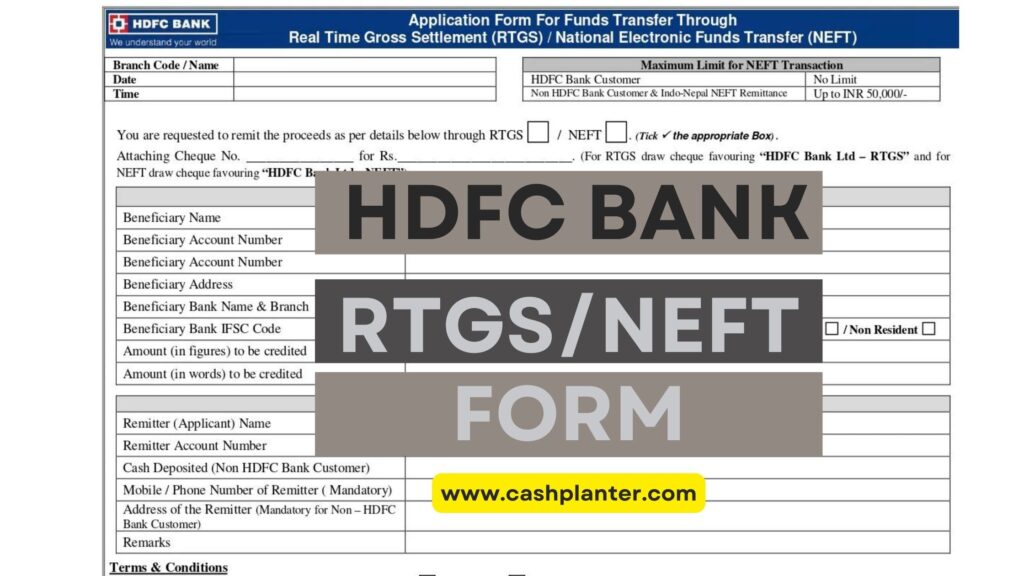

The HDFC Bank RTGS form made available by HDFC bank for transferring funds from HDFC bank account to the beneficiary account through the Real Time Gross Settlement (RTGS) system of the Reserve Bank of India (RBI) payment system method by paying a nominal charges.

What is RTGS payment method?

Real Time Gross Settlement (RTGS) and National Electronic Funds Transfer (NEFT) are two widely used methods for transferring funds electronically in India.

RTGS enables instantaneous transfer of funds from one bank to another on a real-time and gross basis, meaning the transactions are settled individually without bundling or netting with any other transaction. This system is primarily used for large-value transactions.

What is NEFT payment method?

NEFT, on the other hand, operates on a deferred settlement basis and is used for transferring smaller amounts of money. NEFT transactions are settled in batches at specific times throughout the day.

How to use HDFC Bank RTGS form?

To initiate an RTGS or NEFT transfer from your HDFC Bank account to another bank account, you’ll typically need to fill out a form provided by HDFC Bank. These forms can usually be downloaded from the bank’s website in PDF format or you can also download from our website.

Once you’ve downloaded the RTGS or NEFT form, you’ll need to fill in details such as the beneficiary’s account number, IFSC code of the recipient bank branch, the amount to be transferred, and other required information. Make sure to double-check all the details to avoid any errors that could delay or disrupt the transaction. You also need to attach a cheque or a debit instruction along with your HDFC RTGS form or HDFC NEFT form with a copy of your identity proof such as PAN card, Aadhaar card, driving licenses passport, etc.

The benefits of using RTGS and NEFT include speed, convenience, and security. Both systems offer a reliable way to transfer funds electronically, allowing you to make payments or send money to family and friends with ease.

Keep in mind that RTGS typically involves higher transaction fees compared to NEFT, so it’s essential to consider your specific requirements and preferences when choosing between the two options.

Overall, RTGS and NEFT are valuable tools for anyone looking to make quick and secure fund transfers within India. Whether you’re making a large payment or sending money to a loved one, these electronic payment systems provide a convenient solution for your financial needs.

Charges and Limit of HDFC Bank RTGS

Transaction charges for RTGS from HDFC Bank Branches – Rs 15 + Applicable GST (as per official site HDFC bank).

Transaction Limits: Minimum amount: Rs. 2 Lakh Maximum amount for RTGS transactions at a branch: No limit Maximum amount for RTGS transactions via NetBanking: Up to the customer’s TPT limit, with a maximum of Rs. 50 Lakh per day.

Please refer the bank official site for the latest fees and charges for RTGS payment.

Charges and Limit of HDFC Bank NEFT

| Transaction Amount (In Rupees) | Charges |

| Upto Rs 1,00,000 | Rs 2 + Applicable GST |

| Above Rs 1,00,000 | Rs 10 + Applicable GST |

All charges are subject to changes

Transaction Limits:

- 7am to 7pm on RBI working day : The maximum amount of funds that can be transferred per day is as per the customer’s TPT limit (Maximum upto Rs.50 Lakhs)

- From 7pm – 7am on working days & all holidays (including 2nd & 4th Saturdays and Sundays) : A maximum of Rs.2.00 lacs per transaction can be transferred subject to TPT limit. (Multiples of Rs 2 Lacs upto the TPT limit chosen by the customer. Maximum upto Rs. 50 Lakh)

- For security reasons, the bank allows you to transfer money up to Rs 50,000/- only to the newly added beneficiary (in full or parts) during the first 24 hours from adding the new beneficiary.

Please refer the bank official site for the latest fees and charges for RTGS payment.

Note Before initiating the transaction check with the HDFC bank branches.

FAQ

1. Can we download RTGS form online?

Yes, you can download the Real Time Gross Settlement (RTGS) form online from the official website of HDFC Bank. You can also download the RTGS form from www.cashplanter.com. The form is available in PDF format and can be easily accessed and printed for your convenience.

What is the RTGS limit per day?

For HDFC Bank, The minimum remittance amount for RTGS is ₹ 2,00,000/- with no maximum limit.

Is Cheque required for RTGS?

No, a cheque is not required for RTGS transactions. RTGS is a fund transfer mechanism where the transfer of funds takes place in real-time and on a gross basis. All you need are the beneficiary details such as their name, bank account number, IFSC code, and the amount to be transferred.

What is NEFT limit in HDFC?

The National Electronic Funds Transfer (NEFT) limit in HDFC Bank varies depending on the type of account and customer category. As of the latest information, HDFC Bank typically allows retail customers to transfer the highest sum of money that can be transferred in a single day depends on the customer’s Third Party Transfer (TPT) limit. TPT limits differ between banks but usually fall within the range of up to Rs. 50 lakhs.

Is RTGS chargeable?

Yes, RTGS transactions are usually chargeable. HDFC Bank, like most banks, imposes a nominal fee for RTGS transactions. The fee structure may vary based on factors such as the amount being transferred and whether the transaction is initiated online or at a branch. HDFC Bank typically charge from INR 15/- + GST for RTGS. It’s advisable to check with HDFC Bank for the most accurate and up-to-date information on RTGS charges.

HDFC Bank RTGS Form / HDFC Bank NEFT Form

Source : www.hdfcbank.com

Disclaimer: The PDF forms accessible on this website are sourced from the official websites of the respective entities. Additionally, the forms are provided from internet sources. It is important to note that this website is not affiliated with any government entity. Its sole purpose is to facilitate the download of PDF forms. Prior to utilizing any PDF form, it is advisable to verify its authenticity.

While we strive to ensure the accuracy of the provided PDF forms to the best of our knowledge, we do not assume responsibility for any errors that may occur. Users are advised to use the downloaded PDF forms from this website at their own discretion and risk.

Feel free to reach out to us in the event of any updates, as your feedback is invaluable in enhancing the quality of our data. Your collaboration is essential to our continuous improvement efforts. Please contact us with any relevant information that can contribute to refining and updating our data. We appreciate your assistance in maintaining accuracy and relevance in our services.