Are you considering a 20 Lakh Home Loan and wondering about the EMI? Understanding the dynamics of your Equated Monthly Installments (EMIs) is crucial for sound financial planning. When it comes to purchasing your dream home, availing a home loan is often the preferred choice for many individuals.

In this guide, we will explore into the details of a 20 lakh home loan EMI, providing insights into different interest rates and repayment periods with a comprehensive table to aid your decision-making process.

Understanding EMI

EMI, or Equated Monthly Installment, is a fixed amount paid by borrowers to lenders every month. It comprises both the principal amount and the interest on the loan. Home loan EMIs are calculated based on various factors, including the loan amount, interest rate, and tenure.

Factors Affecting Home Loan EMIs

Interest Rate

The interest rate plays a crucial role in determining the EMI amount. A higher interest rate results in higher EMIs and vice versa. Borrowers can choose between fixed and floating interest rates based on their preferences and financial circumstances.

Loan Tenure

The loan tenure refers to the duration for which the borrower takes the loan. Longer tenures result in lower EMIs but higher overall interest payments, while shorter tenures lead to higher EMIs but lower interest payments.

Principal Amount

The principal amount borrowed also influences the EMI calculation. Higher loan amounts result in higher EMIs, while lower loan amounts lead to lower EMIs.

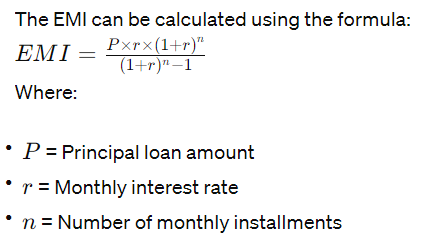

Calculating EMIs

Calculating your EMI involves several factors, including the loan amount, interest rate, and tenure. The formula for EMI calculation is typically:

Using the Formula

EMI = [P x R x (1+R)^N]/[(1+R)^N-1]

- P is the principal loan amount (20 lakh in our case)

- R is the monthly interest rate (annual rate divided by 12)

- N is the number of monthly installments (tenure in years multiplied by 12)

Let’s break down the components further:

Principal Amount

The principal amount refers to the initial loan amount borrowed from the lender, which in our case is 20 lakh.

Interest Rate

The interest rate is the cost of borrowing, expressed as a percentage. It varies based on market conditions and individual creditworthiness. Please refer the table in this article for different interest rate with different tenure

Loan Tenure

The loan tenure represents the duration over which you repay the loan. It significantly influences your EMI amount and overall interest outgo. Please refer the table in this article for different tenure with different interest rate.

Online EMI Calculators

Online EMI calculators are readily available on bank websites and financial portals. These calculators provide instant results by inputting the loan amount, interest rate, and tenure.

You can try our Home Loan EMI Calculator to calculate the EMI.

Table: The monthly EMI for 20 lakh home loan?

A comprehensive table showcasing EMI amounts with different rates and tenures simplifies the decision-making process. Let’s explore a sample table:

| Interest Rate (%) | 5 Years | 7 Years | 10 Years | 15 Years | 20 Years | 25 Years | 30 Years |

|---|---|---|---|---|---|---|---|

| 7 | 39,602 | 30,185 | 23,222 | 17,977 | 15,506 | 14,136 | 13,306 |

| 7.5 | 40,076 | 30,677 | 23,740 | 18,540 | 16,112 | 14,780 | 13,984 |

| 8 | 40,553 | 31,172 | 24,266 | 19,113 | 16,729 | 15,436 | 14,675 |

| 8.5 | 41,033 | 31,673 | 24,797 | 19,695 | 17,356 | 16,105 | 15,378 |

| 9 | 41,517 | 32,178 | 25,335 | 20,285 | 17,995 | 16,784 | 16,092 |

| 9.5 | 42,004 | 32,688 | 25,880 | 20,884 | 18,643 | 17,474 | 16,817 |

| 10 | 42,494 | 33,202 | 26,430 | 21,492 | 19,300 | 18,174 | 17,551 |

Analyzing Your Options

Now that you have a clear overview of the EMI calculations, it’s time to analyze your options based on your financial capabilities and long-term goals. Here are some key considerations:

- Affordability: Assess whether the EMI amount fits within your monthly budget without compromising your lifestyle.

- Interest Rates: Compare interest rates offered by different lenders to secure the best deal with the lowest possible rate.

- Tenure: Balance between opting for a shorter tenure to minimize interest outgo or a longer tenure for lower EMI amounts.

FAQs About 20 Lakh Home Loan EMI

How is EMI Calculated?

EMI calculation involves a complex formula that considers the loan amount, interest rate, and tenure. Several online calculators can help you estimate your EMI accurately.

Can I Prepay My Home Loan?

Yes, most lenders allow prepayment of home loans. However, it’s essential to check for prepayment charges or penalties before making additional payments.

What Happens If I Miss an EMI Payment?

Missing an EMI payment can attract penalties and adversely affect your credit score. It’s advisable to inform your lender beforehand if you anticipate any difficulties in making timely payments.

Is Home Loan Insurance Necessary?

While not mandatory, home loan insurance provides financial security to your family in case of unforeseen events such as death or disability. Consider your individual circumstances before opting for insurance.

Can I Change My EMI Amount?

Some lenders offer the flexibility to modify your EMI amount by adjusting the tenure or interest rate. However, this may impact the total interest paid over the loan tenure.

How Do I Choose the Right Lender?

When selecting a lender for your home loan, consider factors such as interest rates, customer service, processing fees, and prepayment options. Conduct thorough research and compare multiple offers before making a decision.

What is ideal EMI for Home loan?

Typically, it is advisable to ensure that your home loan equated monthly installment (EMI) does not surpass 30% to 40% of your income.

Conclusion

Availing a 20 lakh home loan is a significant financial decision that requires careful consideration and planning. By understanding the intricacies of EMI calculation and analyzing various interest rates and tenure options, you can make an informed choice aligned with your financial goals. Remember to explore multiple lenders, leverage online calculators, and seek expert advice if needed to embark on your homeownership journey confidently.